This long-awaited Budget offered little support and no solutions for independent hospitality businesses.

The uncertainty and drawn-out pre-Budget speculation has been damaging to business confidence at a time when we looked to the Chancellor to restore trust and deliver a fairer system for small food and drink businesses.

We are deeply disappointed that there weren’t any new announcements that will provide tangible support for small and micro businesses across the hospitality, catering and night-time economy.

Despite operating with very little profit, these small businesses contribute so much to our economy and their local communities and have again been taken for granted.

Alan Fox, NCASS CEO

Please get in touch with us via [email protected] to share your thoughts on the Budget and also if you would like us to support you in contacting your MP.

The measures we have been continually lobbying for includes:

- An increase to VAT threshold to protect small and micro businesses

- A reduction in business rates to give long term support to the high street

- Fix National Insurance Contributions boost jobs

- A cut to the rate of VAT for hospitality, catering and night-time economy venues to provide relief, aid recovery, encourage investment and support long-term growth

Because:

- Costs across the board for independent hospitality have risen exponentially

- The VAT threshold has not been increased in line with inflation

- NIC costs have put even more financial pressure on businesses

- The business rate system needs to change

- Our sector should not be paying 20% VAT especially when most food stuff is zero VAT rated

- The cost-of-living crisis continues to have an ongoing impact on the sector; people are going out less and spending less.

How will your business be affected by today’s budget?

Business Rates:

Permanent lower business rates tax rates for over 750,000 retail, hospitality and leisure properties, worth nearly £900m a year from April 2026 – the details of which are yet to be released.

Staffing costs:

- The national living wage will rise from £12.21 to £12.71 an hour from April for over-21s

- The minimum wage for 18- to 20-year-olds will increase by 8.5% to £10.85 an hour

- NMW for 16- and 17-year-olds will rise to £8 per hour, a 6% uplift.

- Funding for under 25 apprenticeships will be free for SMEs

Taxes:

- VAT rate: no change

- VAT threshold: no change

- Tax paid on dividend income will be increased by 2 percentage points.

- From 2028, a high value council tax sur-charge in England for properties worth more than £2m (£2,500) and £5m (£7,500) will be introduced.

- The current 100% relief on capital gains tax on businesses sold to employee ownership trusts will be cut to 50%.

- Alcohol duty will increase in line with inflation

Salaries:

- Income tax, national insurance, personal allowances: the higher-rate threshold and additional-rate threshold are frozen at £12,570, £50,270 and £125,140, respectively, until 2030-31. National insurance contributions by workers will not rise.

- Salary-sacrificed pension contributions above an annual £2,000 threshold will no longer be exempt from national insurance from April 2029.

The Office for Budget Responsibility (OBR) document said that salary-sacrificed pension contributions above £2,000 would be treated as ordinary employee pension contributions in the tax system and therefore be subject to both employer and employee national insurance contributions.

The document said: “The policy results in an increase in NICs (national insurance contributions) which is estimated to raise £4.7 billion in 2029/30 and £2.6 billion in 2030/31.

“The costing assumes that, in most cases, employee pension contributions above £2,000 that were part of a salary-sacrifice scheme will become subject to employer and employee NICs, either because they move to a standard pension scheme or continue in a salary-sacrifice scheme under the new tax arrangements.”

Other measures that could affect you:

- There may be some positive outcomes through the devolved funding being given to 7 mayors across the UK, this money may be used more productively by the mayors who represent combined authority regions and their businesses.

- 2 child benefit cap will be lifted from April 2026.

- Fuel duty cut of 5p will be extended by 2026 and forecourts will be mandated to display wholesale prices.

Other information and links:

- The Budget document

- The Chancellor’s speech in full

- A link to re-watch the Chancellor’s speech

- National Licensing Framework

- Call for evidence re: our tax system will be released soon – we will share more information on this when we receive it.

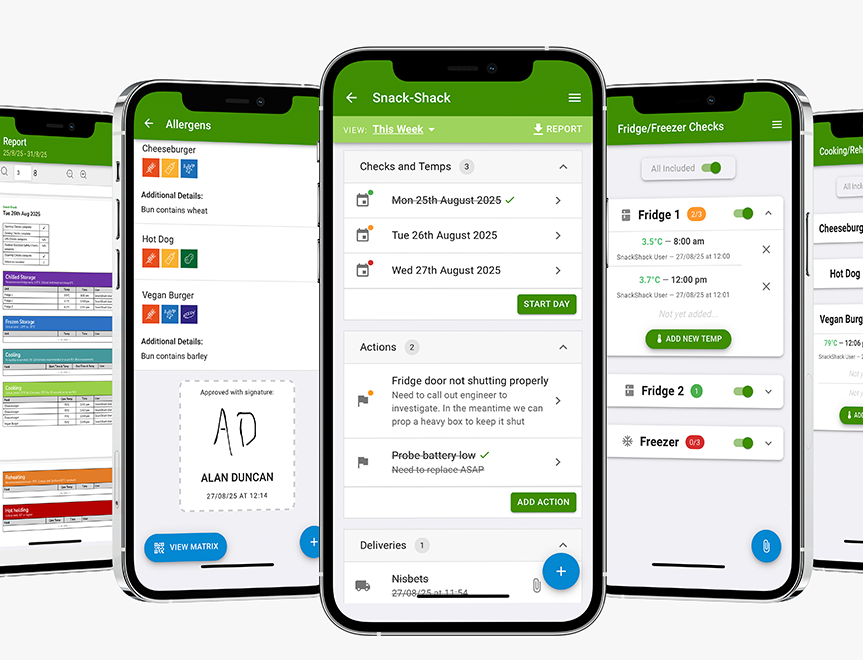

Featured Training

Featured Training

OUR MEMBERSHIP

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails