Chancellor Rachel Reeves unveiled the Government’s 2025 Spending review for the next four years yesterday (11th June 2025).

The spending review outlined £190bn more to the day to day running of our public services over the course of this spending review.

Here are the main announcements to be aware of:

- £29bn per year additional NHS funding

- £39bn over the next decade for affordable housing

- £11bn increase in defence spending

- £22bn per year for R&D funding

- £15bn for transport infrastructure connecting cities and towns

Potential Impact on Hospitality Sector

Transport and Infrastructure: The £15bn of investment to connect our cities and our towns including bus improvements, rail upgrades, and metro extensions should boost accessibility to hospitality venues. The announcement of extending the £3 bus fare cap until at least March 2027 will help customers travel more affordably to restaurants, pubs, and hotels.

Community Investment: The funding for up to 350 communities – especially those in the most deprived areas – to improve parks, youth facilities, and support councils’ efforts against urban decay should help to revitalise high streets where many hospitality businesses operate.

Filling Vacancies: The £1.2bn a year by the end of the spending review to support over a million young people into training and apprenticeships could help address hospitality’s chronic skills shortages.

Key Demands Not Yet Delivered:

- Permanent business rates reform – The temporary 40% relief for 2025-26 isn’t enough. A reform would have predictable cost savings for businesses and would allow more investment in staff, facilities, and expansion. The British Beer & Pub Association urging the government to implement changes and reduce beer duty.

- Lower VAT for small businesses – A reduction in VAT would have provided much-needed relief, enabling businesses to reinvest in their operations, retain staff, and ultimately contribute to the broader economic recovery.

- Tax burden – The sector is particularly struggling with increased employer National Insurance contributions and national minimum wage rises and at current, the Government has refused calls to reverse contributions for small businesses.

To read the 2025 Spending Review in full, click here.

Featured Training

Featured Training

OUR MEMBERSHIP

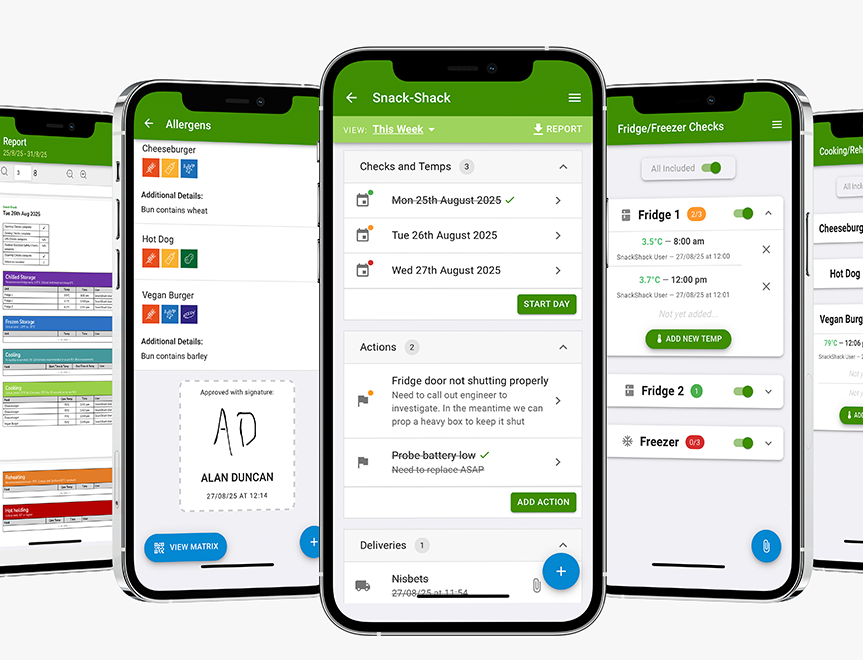

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails