The 2024 Autumn budget was deeply disappointing. It had a devasting impact on the hospitality and catering sector that has led to the reported loss of hospitality businesses across the UK and over 90,000 jobs which is predicted to rise to 111,000 at the time of this year’s Autumn Budget.

The budget as was and continues to be a hammer-blow to business confidence. The independent hospitality sector continues to experience high levels of insolvency and closure and without urgent and targeted support many viable businesses will be lost because of increased costs including stock, rent and energy, unhelpful government policy and insurmountable cost of living pressures.

High and rising costs and an unfair tax burden means that hospitality businesses are having to navigate already wafer-thin profit margins by cutting staff and reducing staff hours, reducing operating hours and changing their product offering. These pressures are felt even more acutely by micro and small businesses.

We appreciate the difficult situation facing the UK Government but ahead of the 2025 Autumn Budget the Chancellor must consider ways to provide support to catering and hospitality businesses. These businesses help to drive economic growth, employ local people (especially young people and those returning to work) and contribute so much to the regional economies in which they operate.

This Budget also provides an opportunity for the Government to recapture the imagination of small businesses that make up the everyday economy and help to deliver a sense of “pride in place”. If we want healthy high streets then we need a healthy hospitality sector to drive footfall, cater for events and promote culture as a driver of economic growth. These businesses, despite operating with very little profit, contribute so much to the high streets and communities in which they serve and have been taken for granted.

In a recent NCASS member survey 80% of respondents told us that a cut to VAT was vital to the survival of their business. It is consistently the single most threatening cost to independent caterers who are faced with a quarterly VAT bill that in most cases wipes out any meaningful profit. These businesses often will absorb the cost of VAT to remain competitive. This issue is a specific concern for catering businesses as they cannot claim VAT back on most of the stock that they buy because it is zero rated.

These businesses operate with small profit margins and increasing cost pressures mean that they lack financial security and feel like they simply act as ‘tax collectors’ for HMRC.

The Treasury should raise the VAT threshold from £90,000 to £150,000 reflecting inflationary pressures and introduce a VAT smoothing mechanism to ease businesses crossing the VAT threshold. There is a growing divide between small business who have little VAT to reclaim and larger operators and chains. Providing relief for eligible micro businesses by reducing their annual VAT liability would encourage growth, support independents, stimulate business activity in local neighbourhoods and reduce any incentive to stay below the threshold.

Ahead of the Autumn Budget we urge the Government to provide targeted support for small, independently run hospitality businesses:

- Reduce VAT for hospitality, catering and night-time economy venues in line with Europe (10-13%) to boost recovery, encourage investment and support long-term growth.

- Raise the VAT threshold to support small and micro businesses.

- Scrap the 20% VAT on hot food prepared and sold for immediate consumption.

- Quickly introduce the new business rates regime and make sure that the new system of non-domestic rates permanently reduces the burden on small hospitality venues.

- Reverse the decision to increased Employer National Insurance Contributions that has been so damaging to a sector reliant on part-time staff, young people and those returning to work from welfare.

- Ensure that hospitality businesses can access the same protections available to the domestic energy market to support with commercial energy costs.

The Nationwide Caterers Association (NCASS) represents over 6500 members in the hospitality and catering sector. Our members include bars, restaurants and cafes as well as street food, festival and event caterers and other businesses with food and beverage functions. Combined, our members own or rent over 350,000 mobile and bricks & mortar sites across the UK.

The value of these businesses goes beyond any measure of economic productivity. These businesses aren’t just economic units; they are cultural and social anchors. They provide vital “third places” for communities, support local supply chains, attract investment and growth and offer meaningful flexible employment. Now is the time for a fairer system and tangible support for the independent hospitality sector.

Alan Fox

Chief Executive

Nationwide Caterers Association

Featured Training

Featured Training

OUR MEMBERSHIP

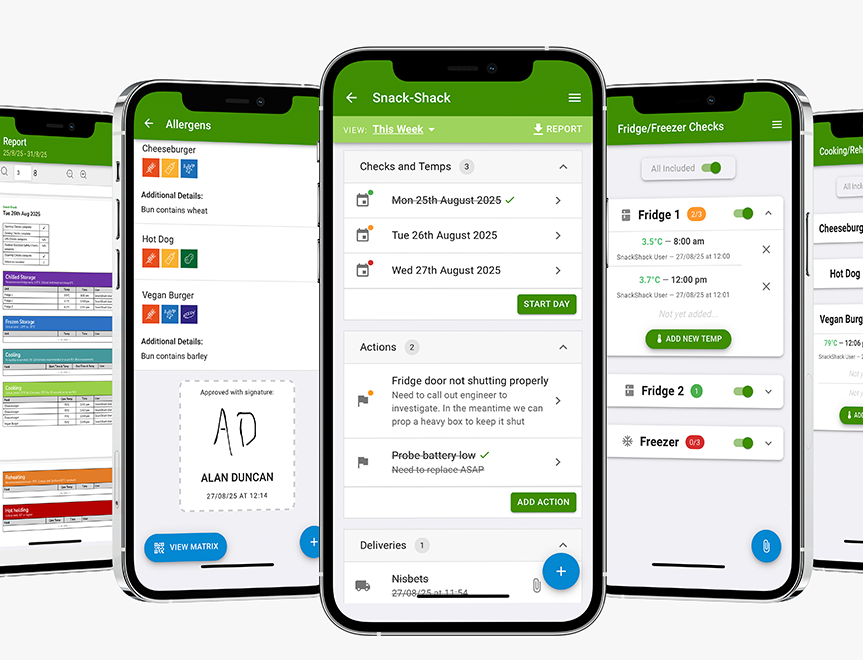

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails