Membership Packages

Membership packages for Mobile & Fixed Site food & drink businesses.

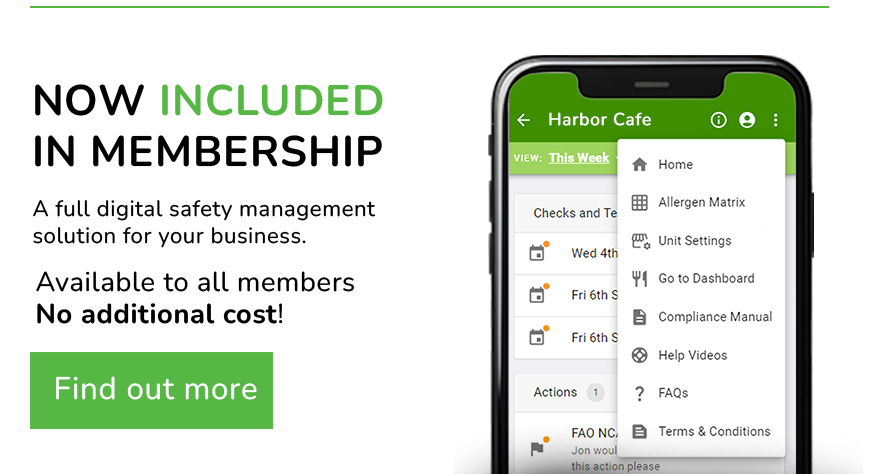

Safety Management System

Our industry-leading Safety Management System is included in all memberships.

Click below to find out more

Our new Digital Safety Management System is now available!

Featured Training

Featured Training