Have you been contacted by an agent who has suggested you could be eligible for R&D?

R&D tax relief supports companies that work on innovative projects in science and technology. Your project must aim to create an advance in the overall field, not just for your business.

R&D tax relief has very high levels of incorrect claims. HMRC are aware that the hospitality sector is being targeted by some agents who are persuading businesses to make ineligible claims.

These agents will often promise a ‘100% success rate’ and a guarantee of ‘no HMRC investigation’. Some agents also falsely claim to be ‘HMRC approved’ or have a special relationship with HMRC. Once a claim has been paid, they will take their fee from the claim and then often become unreachable once HMRC begins investigating.

If it is determined by HMRC that your R&D tax relief claim is ineligible, you will have to pay the amount received back in full plus interest. This includes any of the money taken from the claim by the R&D agent as part of their fee.

Claims from the hospitality sector are highly unlikely to be eligible for R&D tax relief, so unless you already intended to undertake R&D you should be very sceptical if an agent suggests your business is eligible.

As an eligible R&D claim is about advancing science or technology, it is expected that claims must include evidence of research undertaken to resolve scientific or technological uncertainties. For example, trialling new recipes would not be considered R&D eligible for tax relief.

If you are contacted by an agent offering to make an R&D claim on your behalf:

1. Do not take any immediate action to submit an R&D claim and be aware that an eligible R&D claim from the hospitality sector (including restaurants and takeaways) would be highly unlikely.

2. Never share your HMRC log in details with anyone else, including your agent. You should treat them with the same amount of care as your bank details. Giving sensitive, personal information to other people, even without realising, puts you at risk. Someone using your login details could defraud you and HMRC. Keep your HMRC login details safe.

3. Review R&D tax relief guidance on GOV.UK for more information on what is and isn’t eligible for R&D and to find out what to do next. To find out more about claiming R&D tax relief, watch the ‘How do I claim Research and Development tax relief’ video and take a look at the Guidelines for Compliance.

4. If you have not previously claimed for R&D tax relief, you can submit details of your claim to HMRC for a view on eligibility through our advanced assurance process. It is a voluntary scheme, which you can use as a guarantee that your R&D tax relief claim will be accepted if it’s in line with what was discussed and agreed in your application. For more information on advanced assurance please visit Apply for Research and Development (R&D) tax-relief advance assurance – GOV.UK

5. For further help and support, contact HMRC by email at [email protected]

Featured Training

Featured Training

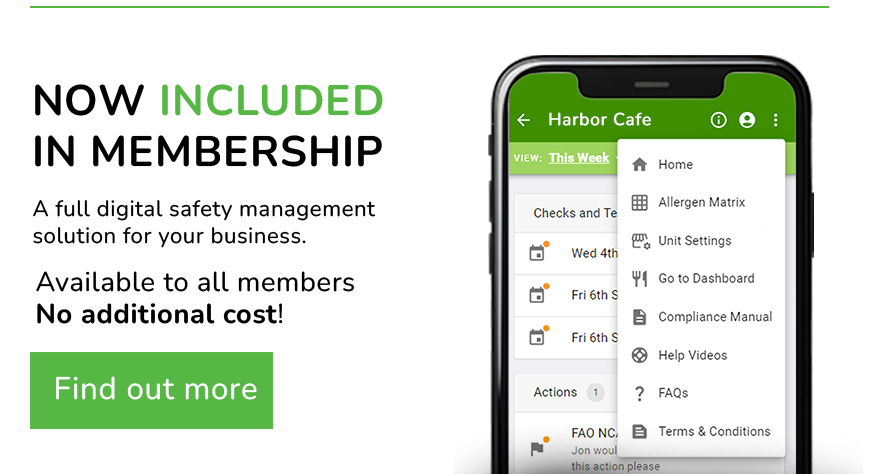

OUR MEMBERSHIP

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails