On the 24th of January NCASS submitted our representation for the Spring Budget to the treasury. Before every budget there is a period of representation where individuals, businesses and organisations can share the challenges they are facing, give examples and statistics and propose solutions that would support them best.

We are campaigning for change for you with our #empowerindependents campaign and ask that if you haven’t already done, please take part in our survey here.

Here is a summary of our representation:

In the Autumn statement, the chancellor announced over £4bn worth of support for ‘small businesses and the hospitality sector’, including 75% business rates relief and freezing alcohol duty rates. However, we believe that the benefits of this were felt by large corporate hospitality businesses, not the independent businesses sector who make up the vast majority of the industry.

We have proposed a range of potential support options in letters to the Treasury and the Minister for Hospitality since the cost of operating crisis began in 2021. The options have not been considered and a carbon copy response was received each time.

The hospitality sector we represent is part of the nighttime industries, events, festival and F&B sectors and the associations across these sectors unanimously believe that a VAT cut is crucial for our collective survival. In fact, in our recent survey: 73% of businesses told us that a VAT cut would be vital to their business and 82% were not satisfied with the government’s support for the hospitality sector.

In more certain times the businesses we represent are productive, profitable employers and taxpayers. However, the significant increase in costs for hospitality businesses, coupled with the cost-of-living crisis, has created a situation where tax revenues are increasing, and well-run businesses are being forced to close or ‘operate as tax collectors’ with no margin for profit left after paying VAT.

The situation is unsustainable, with taxation being the lever that could have the most impact in enabling businesses to survive this shock. Changes to the VAT rules to bring them into line with the rest of the EU would allow businesses to survive and plan for growth.

Through much of covid the only government support provided to NCASS members was government backed debt. Now, our members are being hit by record inflation that is also increasing tax liabilities, while hollowing out margins.

We continue to argue that a greater understanding of and engagement with micro and small businesses will enable better legislation and more appropriate taxation, leading in turn to growth and increased productivity. However, government support for the engine room of the UK economy, small and micro businesses – regularly falls flat, or misses those most in need of support.

The hospitality industry, still reeling from the effects of the pandemic, faces increased costs across the board and no change in VAT or tax thresholds at a time when many are struggling to stay afloat. We are extremely concerned about how this is impacting our members’ ability to sustain their businesses and continue providing employment opportunities especially when:

Survey respondents told us that:

- GP has dropped from between 10 and 45% on average in the last 18 months

- Staffing costs, energy, stock, rent and VAT payments have increased

- They have raised their prices and 80% have been forced to reduce overheads by cutting staff numbers

More needs to be done to assist the small independent businesses that make our high streets, towns and cities what they are today – every single one forms the heart of its own community, has families to support, employees to pay and ambitions to achieve.

Alongside associations in the wider hospitality sector including the night-time industries, festivals and events, we urge you to provide a VAT cut for small and micro hospitality businesses so that it is closer to EU and G7 partners. We must work together to ensure the sustainability and growth of the hospitality industry, a key contributor to the UK’s economy and community life. We need to lay the foundations for economic growth, greater productivity, and ultimately greater tax yields and this means we need change.

We welcome the opportunity to discuss further the ongoing challenges that our sector faces and importantly how the government can act now to prevent more unnecessary and avoidable independent hospitality business closures across the UK.

Featured Training

Featured Training

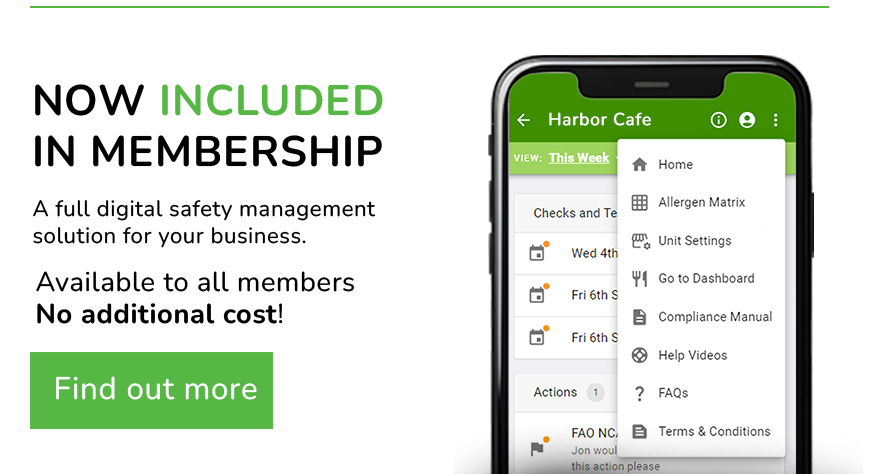

OUR MEMBERSHIP

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails