This article is correct at time of writing 01.03.21

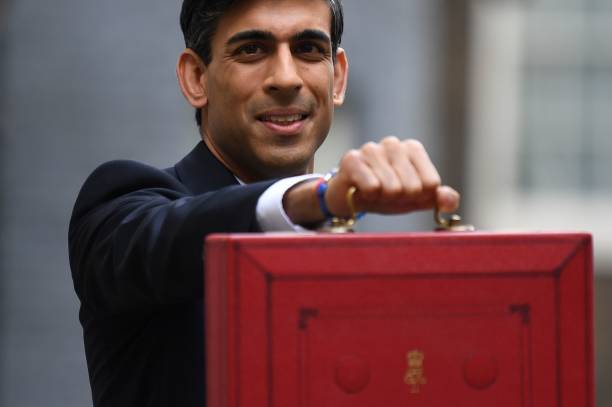

The Chancellor Rishi Sunak is set to announce the Budget on Wednesday 3rd March and there has been much speculation in the news already about what he might announce. Here’s what’s been reported so far:

- Sunak is to announce grants of up to £18,000 for hospitality businesses as part of a one-off £5b grant scheme.

- The grants, which cover hospitality, accommodation, leisure, personal care and gym businesses in England, will be allocated based on the value of a property. Premises with a rateable value of £15,000 or under will be entitled to £8,000; those with a rateable value between £15,000 and £51,000 will be allowed £12,000; and £18,000 will be made available to properties with a rateable value of £51,000 or over.

- Mr Sunak signalled on Sunday he will use the Budget to set a course for belt-tightening to pay down the UK’s £2 trillion national debt, declaring he intends to “level with people” about the perilous state of the public finances. However it remained unclear whether his planned tax raids – expected to include a rise in corporation tax to as much as 25 per cent and a freeze on income tax thresholds to drag more workers into higher bands – will be immediate or phased in over the coming years.

- Mr Sunak indicated he will extend furlough, business support and the £20-a-week uplift to welfare benefits in “alignment” with Boris Johnson’s 21st June timetable for lifting lockdown.

Hospitality sector VAT

Already extended once, the temporary reduction from 20% to 5% is likely to be pushed back to the summer, possibly for three months beyond the current 31st March cut-off. A delay could add £800m to the estimated £3.3bn cost so far.

Business rates relief

An extension in the temporary 100% tax cut for hospitality, retail and leisure is expected. Last year, larger firms paid back £2bn of unused relief on the tax, which is levied on commercial properties, and it could help fund a continuation of the subsidy. A more fundamental review of business rates and a potential online sales tax to help boost bricks and mortar retailers have been delayed until an autumn budget.

Business grants

£600m of funds made available in January for the hardest hit firms, many of them in the hospitality, leisure and tourism sectors, could be topped up.

Restart grants

Nearly 700,000 shops, restaurants, hotels, hair salons, gyms and other businesses in England, will be eligible for the so-called “restart grants”, to be distributed directly to firms by local authorities from April. It will replace the current monthly grant system.

The funding takes the total spent on direct grants to businesses during the pandemic to £25bn, the Treasury said. The devolved nations will receive equivalent extra funding.

We will update our news section regularly with the latest government funding updates.

Featured Training

Featured Training

OUR MEMBERSHIP

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails