The Catering Accounting Company has issued further guidance on the Government’s announcement to temporarily reduce VAT rate supplies to 5% during the Coronavirus pandemic.

Accountant Andrew James will be joining us in our upcoming webinar – NCASS Live – Finance Focus – The Hospitality VAT Cut on Tuesday 21st July to discuss the changes and to answer any questions you might have on the impact it will have on your business.

If you have any questions you’d like to put to Andrew live during the show, email them to [email protected].

The temporary 5% VAT rate

Basic outline

- The Government are reducing certain VAT rated supplies down from the 20% standard rate down to a 5% temporary rate.

- It covers the period from 15th July 2020 to 12th January 2021.

- Aimed at the hospitality, hotel and holiday accommodation sectors as well as admissions to certain attractions.

Food and drink

The temporary rate can apply to:

- The supply of food and non-alcoholic drinks for the consumption on the business premises such as pubs, cafes, restaurants and similar establishments.

- The supply of hot takeaway food and hot (non-alcoholic) takeaway beverages.

The temporary rate does not apply to:

- Alcoholic drinks. The supply remains standard rated.

- Any supplies of food and drinks that are supplied as part of a supply of catering services for consumption off the premises. The supply remains standard rated.

Hotel and holiday accommodation

The temporary rate can apply to:

- The provision of sleeping accommodation in hotels, inns, boarding houses, B&Bs, private residential clubs, hostels, serviced flats (other than those for permanent residential use).

- The supply of seasonal pitches for caravans, including supplies of facilities provided in relation to the occupation of the pitches.

- The provision of pitches for tents and camping facilities.

Admission to certain attractions

The temporary rate can apply to:

- Admission fees to attractions like theatres, museums, fairs, zoos, amusement parks, shows, studio tours, factory tours, cultural events.

- If the main supply is the admission fee and there is an incidental supply included as well, the whole supply will attract the temporary reduced rate.

Please note:

- If the admission fee is currently VAT exempt that takes precedence over the temporary measure.

Other issues to note

- If you are using the Flat Rate Scheme then certain percentages within the Scheme will be reduced by HMRC to take account of the temporary measure.

- The temporary reduced rate will have an impact on those business using the Tour Operators Margin Scheme

Featured Training

Featured Training

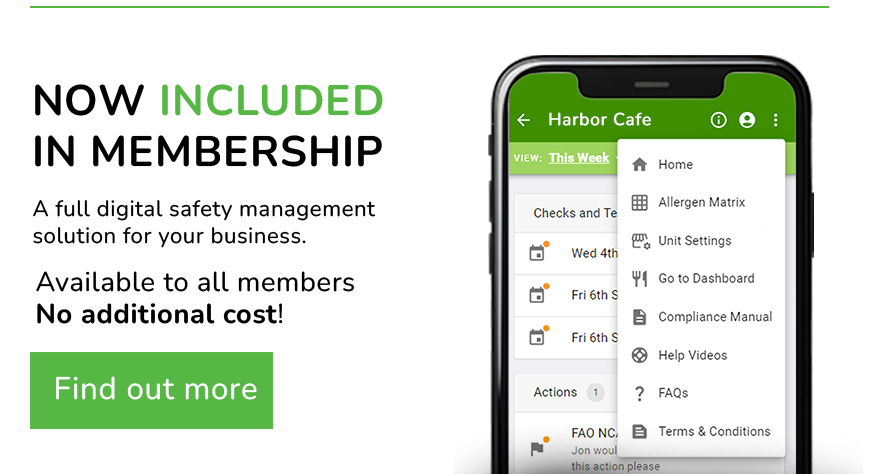

OUR MEMBERSHIP

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails